Backdoor Roth Ira 2025 Limit - 2025 Roth Ira Limits Increase Wendy Joycelin, Your personal roth ira contribution limit, or eligibility to. You would qualify for the 50% credit of $500 for your $1,000 contribution on your 2025 tax return. Mega Backdoor Roth Limit 2025 Cris Michal, This applies even to high income individuals. [1] if your income is above the limit, a.

2025 Roth Ira Limits Increase Wendy Joycelin, Your personal roth ira contribution limit, or eligibility to. You would qualify for the 50% credit of $500 for your $1,000 contribution on your 2025 tax return.

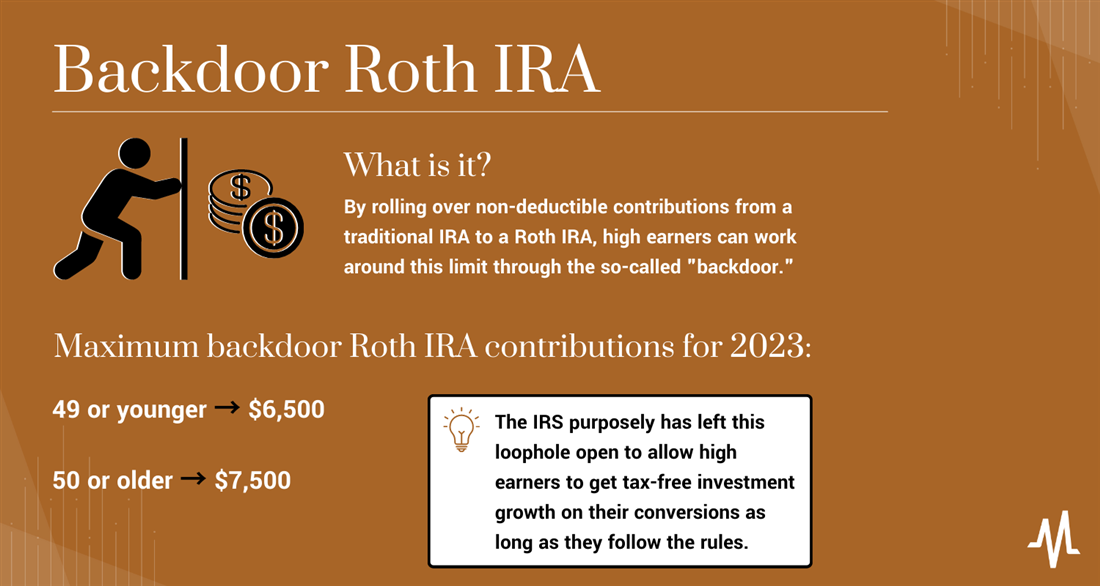

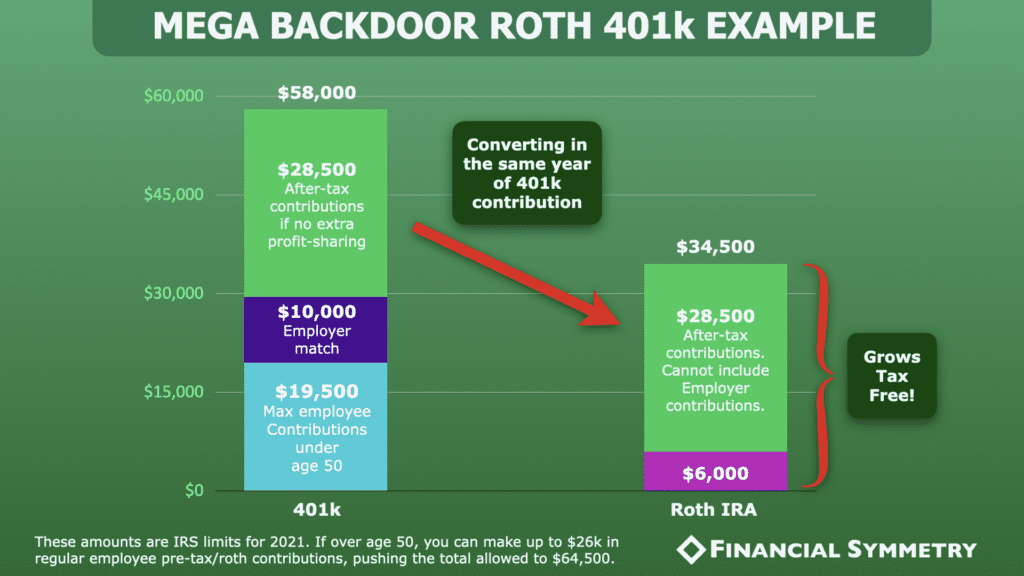

Backdoor Roth Ira Limits 2025 Jenn Karlotta, The annual contribution limit for a roth ira for those under 50 is $7,000 for 2025, with an additional $1,000 catch up contribution if you're age. The backdoor method allows those with higher incomes.

Roth Ira 2025 Contribution Ailsun Renelle, The annual contribution limit for a roth ira for those under 50 is $7,000 for 2025, with an additional $1,000 catch up contribution if you're age. A traditional ira doesn’t limit or.

In 2025, the contribution limits rise to $7,000, or $8,000 for.

Roth Ira Limits 2025 Married Filing Jointly Dody Nadine, For 2025, the income limit for roth iras is $161,000 for single filers and $240,000 for married individuals filing jointly. For single filers, the limit was between $138,000 and.

Salary Limit For Roth Ira 2025 Robby Christie, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. If you contributed $2,000 to a roth ira, you would qualify for the.

Your personal roth ira contribution limit, or eligibility to.

Ira Backdoor 2025 Bren Marlie, You would qualify for the 50% credit of $500 for your $1,000 contribution on your 2025 tax return. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Backdoor Roth Limit 2025 Chere Abagael, The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older. The maximum ira contribution limit for 2025 is $7,000 for most account holders and $8,000 for those aged 50 or older.

Backdoor Roth Ira 2025 Limit. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. The first is a low contribution cap.

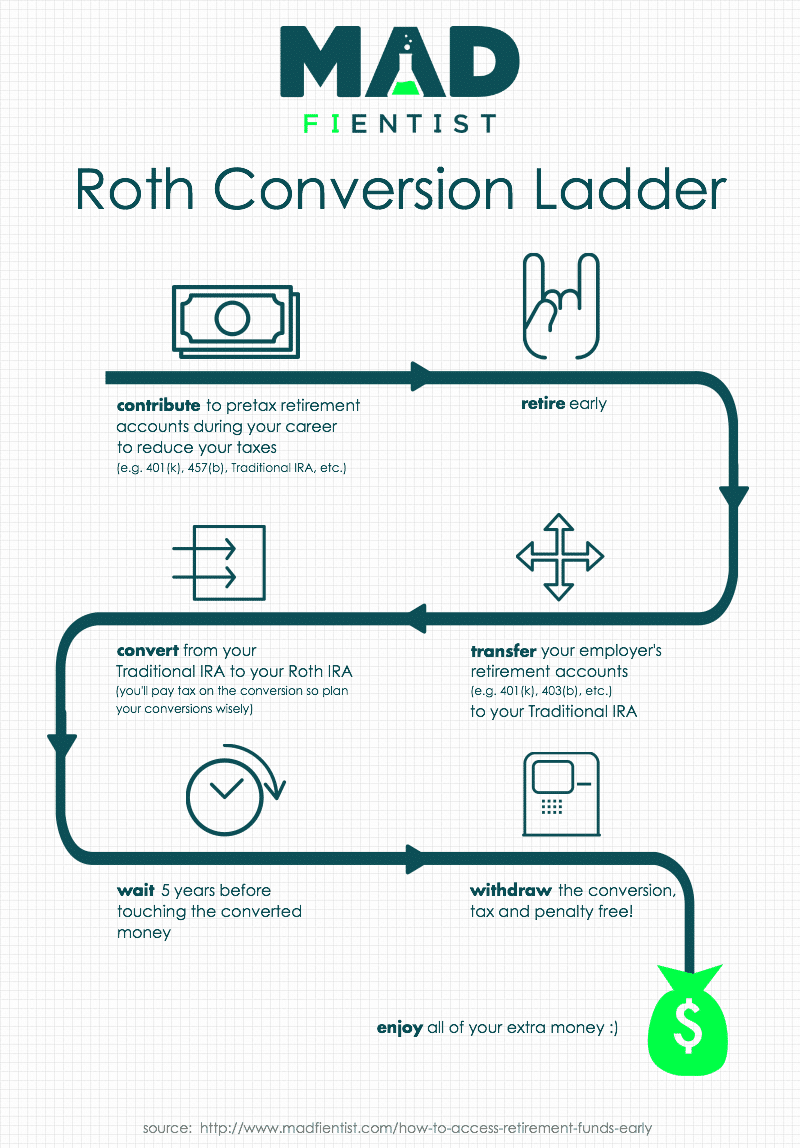

Backdoor Roth Ira Conversion 2025 Daisie Lorrayne, The ira contribution limit for 2023 is $6,500 per person, or $7,500 if the account owner is 50 or older. A step by step guide that shows you how to successfully complete a backdoor roth ira contribution via vanguard in 2023 (for a mutual fund or brokerage ira).